Ready for Dallas CVTA? Join us at the 2024 Spring Conference from May 1-3, where industry leaders unite to shape the future of commercial vehicle training!

- Ready for Dallas CVTA? Join us at the 2024 Spring Conference from May 1-3, where industry leaders unite to shape the future of commercial vehicle training!

Revolutionizing Loan Servicing

Primary Servicing

We offer industry-leading primary servicing solutions, encompassing new account onboarding, efficient receivables management, and frictionless omnichannel borrower communications––all within comprehensive compliance standards. Get personalized support through dedicated Partner Success Managers and access in-depth reporting and analytics.

Backup Servicing

Our backup loan servicing includes uncompromising data security, leveraging advanced measures including physical security protocols, encryption technologies, and robust access controls. Geographically diverse backup locations mitigate the risk of data loss from localized incidents or disruptions.

Loan Financing

With institutions across the country competing for enrollments, securing financing for qualified students helps meet enrollment needs. Increase enrollments and help underserved students get the education they deserve with our financing solutions.

Customized.

Frictionless.

Results You Can Measure

25+

Years in Business

400+

Customizable Dashboards

$1,500B+

Assets Managed

165,000+

Consumer Loans Serviced

Hindsight to Insight

Every lender has different exposures and risks depending on their clientele. With real-time, customized data, we offer a depth and breadth of analytics that helps you make critical decisions in less time without needing to outsource or in-house reporting work.

READY TO TAKE THE NEXT STEP?

We’re ready to listen and develop a solution that works for your unique needs. Speak today with a Loan Servicing Specialist.

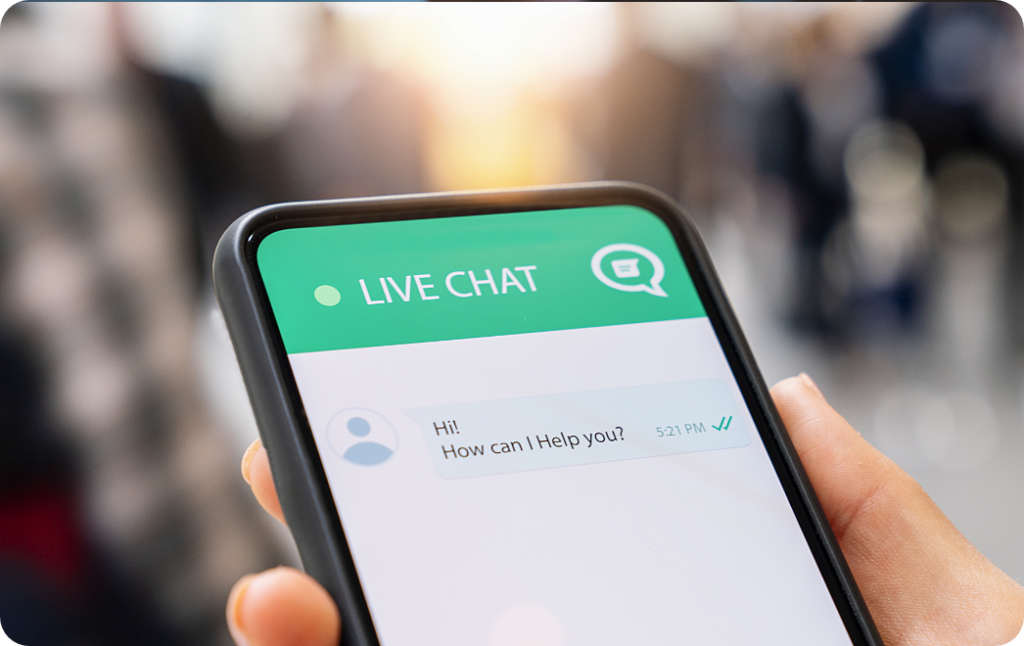

Omni-Channel

Communication

With seamless interaction across various channels, our borrowers can engage effortlessly through their preferred means of communication such as SMS, chat, email, or phone, ensuring a high-touch approach for high rates of collection.

SMS

Borrowers can receive timely reminders, payment updates, and helpful tips delivered straight to their messages, ensuring they stay on track with payments.

CHAT

A live chat function can help borrowers address any questions, comments, or concerns they may have about their loans, ensuring that issues are resolved quickly.

For borrowers who prefer email as a mode of communication, they can receive payment notices, reminders, newsletters, and other helpful information delivered right to their inbox.

PHONE

Sometimes, you just want to talk to someone to discuss more complicated issues. For these borrowers, our customer service reps can help solve issues faster so they can resume payments.

Account Servicing is managed by Paramount Capital Group, LLC, NMLS #1114719. CA debt collector license #10508-99. For more information, visit NMLS Consumer Access www.nmlsconsumeraccess.org.

NV Collection Agency License FCA10726, NV Compliance Manager certificate CM12548. © Copyright 2024 – Paramount Capital Group, LLC | Privacy Policy | Terms of Service

Website By Farotech